Maintenance and distribution networks

Chiffres clés*

______

Millions of workshop entries in 2022

* Source: ANFA "Autofocus n°105/GIPA 2023

% of maintenance operations on vehicles over 15 years old are carried out "Do-It-Yourself "*.

Average age of vehicles on the road

All-make spare parts and automobile service distribution networks

________

The vast majority of all-make automotive parts and service distributors in France are grouped under banners run by a dozen or so purchasing and service alliances.

These groups represent 2,230 sites (*), or 2/3 of the total number of distributor outlets in France (3,700 outlets in all, see below).

Sector talking points

____

Automotive mechanical repair networks

_____

All-make car mechanical repair networks are the all-make competitors of brand dealers and authorised sellers. They now represent more than 9,000 workshops, i.e., the majority of the 13,000 all-make repair workshops in France.

The majority of network brands are run by parts and service distributor alliances (e.g., Autodistribution), which together represent nearly 6,700 affiliated workshops. The other 2,750 network workshops are run by car manufacturers: Eurorépar for Stellantis, Motrio for Renault, Motorcraft for Ford.

The table below lists the brands, the groups to which they belong and the number of workshops.

Automotive body shop networks

_____

There are around 11,000 body shops in France (source: paint manufacturers), of which around 3,500 specialise entirely in bodywork and repairs. The majority are mixed mechanical and bodywork workshops.

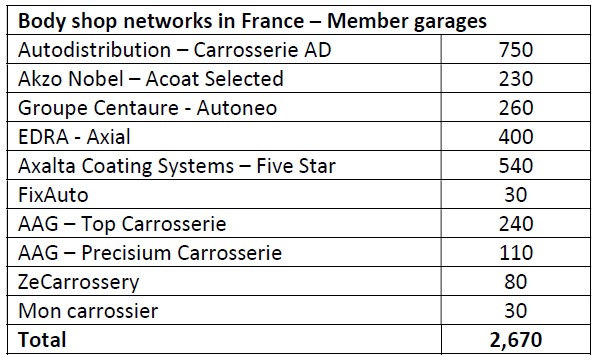

Creating networks also remains a major trend, as it is in mechanical repairs. As regards specialist body shops, 2,670 companies have formed 10 networks (see table below). Some are run by paint manufacturers, some by distribution alliances, and some, like Axial (EDRA Group), are entirely independent.

Other brands: fast fitters, tyre dealers and auto centres

_____

Roadworthiness testing

_____

First introduced in France in 1991, roadworthiness testing (known as MOT testing in the UK) is a public service delegated by the Ministry of Ecology, Energy and Territories. In France, roadworthiness tests assess the mechanical condition of every car, van and HGV in the fleet, and are carried out exclusively in premises that are separate from the car servicing sector, to ensure that the results of mandatory tests are impartial and not used for commercial purposes.

There are almost 6,700 roadworthiness testing centres in France, with a total of 11,500 employees (source: ANFA). They carried out 25.56 million roadworthiness tests on passenger cars and light vehicles in 2022 (source: Ministry of Ecology).

The testing specifications change regularly. The latest reform dates from 2021, with the precise measurement of the opacity of diesel engine fumes.

Roadworthiness tests for powered two and three-wheelers are expected to be introduced in France in 2024.

The sector's product categories

___

Auto body repair networks

Auto body repair networks; Detailing specialists; Fast fitters and used vehicle preparation networks

Auto glass repair networks

Garage networks

Miscellaneous dealerships (microcars and other motor driven machines)

MOT testing networks

Vehicle manufacturers

After-sales service; Customer service; Dealer networks; Multi-brand networks; Spare parts

Wholesale groups - Franchises - Auto centres

Auto centers; Distribution centres; Fast fitters; Franchised networks; Wholesale groups - Buying groups